Get the free virginia offer in compromise business form - tax virginia

Show details

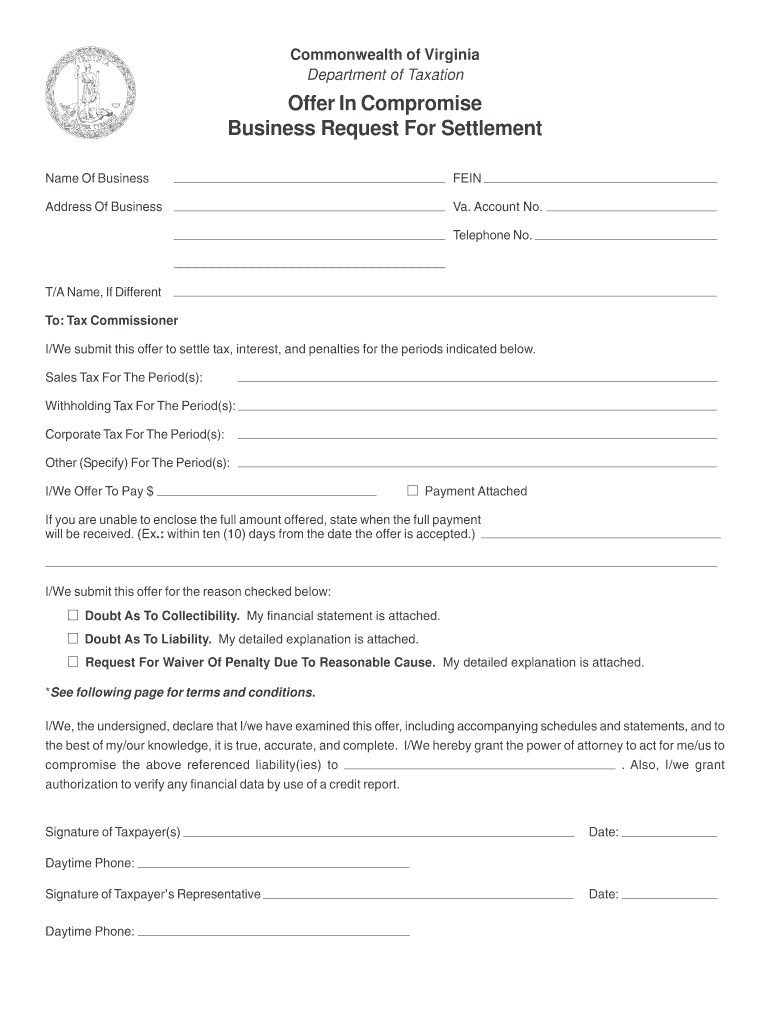

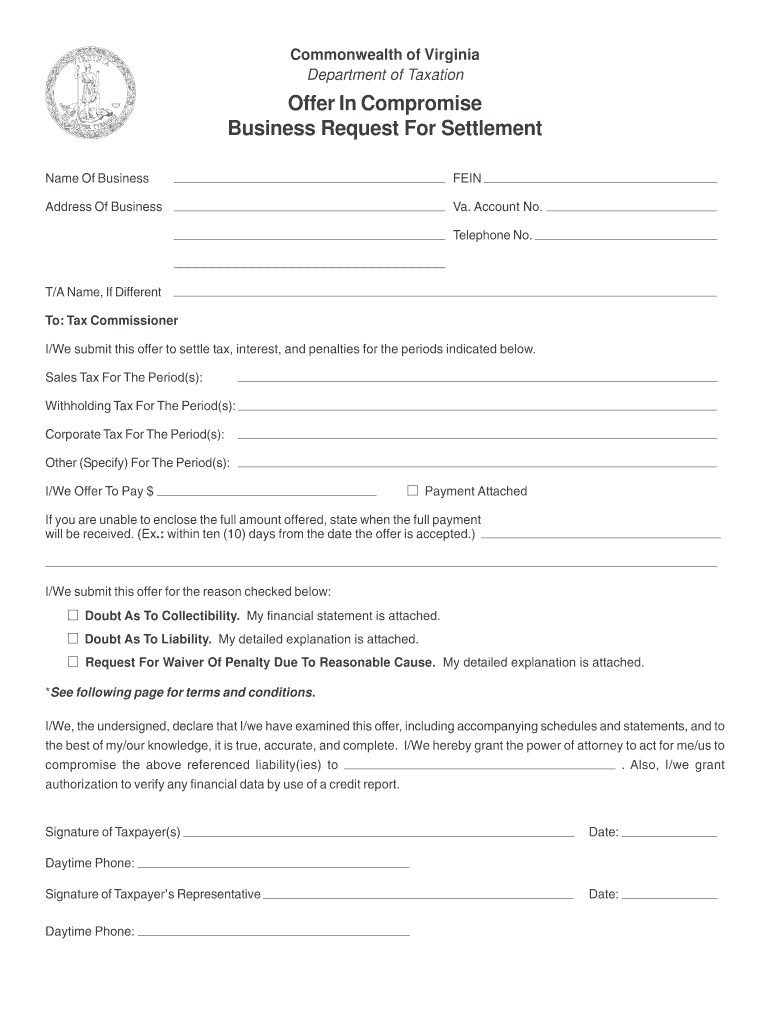

Commonwealth of Virginia Department of Taxation Offer In Compromise Business Request For Settlement Name Of Business VEIN Address Of Business Va. Account No. Telephone No. T/A Name, If Different To:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your virginia offer in compromise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virginia offer in compromise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing virginia offer in compromise online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit virginia offer in compromise. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out virginia offer in compromise

How to fill out Virginia offer in compromise:

01

Gather all necessary documentation, such as tax returns, financial statements, and proof of income.

02

Complete the Virginia offer in compromise form accurately and thoroughly, providing all requested information.

03

Calculate and propose a reasonable offer amount that you can afford to pay to the Virginia Department of Taxation.

04

Include a detailed explanation and justification for the proposed settlement offer, highlighting any financial hardships or extenuating circumstances.

05

Submit the completed offer in compromise form along with all supporting documents to the Virginia Department of Taxation.

06

Keep copies of all submitted documents for your records and follow up with the department to ensure they have received your offer.

07

Await a response from the Virginia Department of Taxation regarding the acceptance or rejection of your offer.

08

If your offer is accepted, make the agreed-upon payment promptly and fulfill any additional requirements outlined by the department.

09

If your offer is rejected, consider appealing the decision or explore alternative options for resolving your tax debt.

Who needs Virginia offer in compromise:

01

Individuals or businesses who owe back taxes to the Virginia Department of Taxation.

02

Taxpayers who are facing financial hardship and are unable to pay their entire tax debt.

03

Taxpayers who believe that they qualify for a reduced settlement amount based on their financial circumstances.

Fill form : Try Risk Free

People Also Ask about virginia offer in compromise

Who must file Virginia form 502?

What is the Virginia form R 5 for?

What is Virginia form 760cg?

What is Virginia income tax withholding exemption certificate?

What is a 763 form in Virginia?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is virginia offer in compromise?

Virginia offer in compromise refers to a program offered by the Virginia Department of Taxation, which allows eligible taxpayers to settle their tax liabilities for less than the full amount owed. This program is designed for taxpayers who are unable to pay their tax debt in full and provides a way for them to potentially resolve their tax debts and avoid further collection efforts.

Under the Virginia offer in compromise program, taxpayers are required to submit a detailed financial statement, disclosing their assets, income, and expenses. The Department of Taxation will review this information to determine a taxpayer's ability to pay the tax debt. If it is determined that the taxpayer cannot pay the full amount owed, an offer in compromise may be accepted.

If the offer is accepted, the taxpayer is required to make a lump sum payment or agree to a payment plan to settle the tax debt. The exact amount of the offer will depend on the taxpayer's financial situation and the Department of Taxation's assessment of their ability to pay.

It is important to note that not all taxpayers will qualify for the Virginia offer in compromise program, and the acceptance of an offer is at the discretion of the Department of Taxation. Additionally, taxpayers must comply with all tax laws and filing requirements in the future to remain in good standing with the department.

Who is required to file virginia offer in compromise?

Individuals or businesses who owe a tax debt to the Virginia Department of Taxation may be required to file an Offer in Compromise (OIC). An OIC is a formal request to settle their tax debt for less than the full amount owed, based on the taxpayer's financial situation and ability to pay. However, it is important to consult with a tax professional or the Virginia Department of Taxation for specific eligibility criteria and requirements for filing an OIC in Virginia.

How to fill out virginia offer in compromise?

To fill out a Virginia Offer in Compromise, follow these steps:

1. Obtain the necessary forms: The Virginia Department of Taxation provides the Offer in Compromise (Form OIC-01), which can be downloaded from their website.

2. Gather supporting documentation: Collect all relevant financial records, including financial statements, bank statements, pay stubs, and tax returns. Documentation should demonstrate your inability to pay the full tax debt.

3. Complete the personal information section: Provide your name, address, contact information, and Social Security number in the designated fields.

4. Provide tax information: Identify the tax type, tax period, and amount owed for each tax liability being included in the offer.

5. Calculate your offer amount: Determine the total offer amount you can afford to pay. Consider your income, expenses, and assets. The Virginia Department of Taxation may use a formula to evaluate your offer amount, or you can propose your own amount.

6. Include a written explanation: Attach a detailed explanation of why you are unable to pay the full tax debt. Describe any extenuating circumstances, financial hardships, or medical issues that have impacted your ability to pay.

7. Submit supporting documentation: Include copies of all financial records and documents that support your inability to pay the tax debt. Be sure to label and organize the materials properly.

8. Sign and date the form: Read the certification statement, sign, and date the form accordingly. Unsigned offers will not be accepted.

9. Submit the offer: Mail the completed Form OIC-01 and supporting documentation to the Virginia Department of Taxation at the address provided on their website. Retain a copy of all documents for your records.

Keep in mind that an Offer in Compromise is not guaranteed to be accepted. The Virginia Department of Taxation will review your submission and make a decision based on your financial situation and the merits of your case.

What is the purpose of virginia offer in compromise?

The purpose of the Virginia offer in compromise is to provide individuals or businesses with the opportunity to settle their tax liabilities for less than the full amount owed. It is a program offered by the Virginia Department of Taxation, allowing taxpayers to negotiate a compromise agreement based on their ability to pay and their financial situation. This program aims to help taxpayers resolve their tax debts, while also ensuring the state receives some payment rather than none.

What information must be reported on virginia offer in compromise?

When submitting an offer in compromise in Virginia, the following information must be reported:

1. Personal Information: Full name, address, Social Security number, and contact details of the applicant.

2. Taxpayer Identification: Provide specific tax identification numbers, such as your individual taxpayer identification number (ITIN) or employer identification number (EIN).

3. Tax Liability: Clearly state the tax years and types of tax liabilities for which the offer in compromise is being made. This includes income tax, sales tax, business tax, etc.

4. Financial Information: Complete a detailed financial statement disclosing income, expenses, assets, and liabilities. This may involve providing supporting documents such as pay stubs, bank statements, and asset valuations.

5. Monthly Living Expenses: Report all necessary living expenses, including food, housing, transportation, healthcare, and medical expenses.

6. Offer Amount: Specify the amount offered as a compromise to settle the tax debt.

7. Reason and Justification: Provide a complete explanation and documentation as to why the offered amount is appropriate and justified based on your financial situation.

8. Supporting Documents: Attach all supporting documents, such as bank statements, pay stubs, tax filings, and any other relevant financial statements.

It is crucial to ensure the accuracy and completeness of the information provided to avoid delays or rejection of the offer in compromise. Consulting with a tax professional or the Virginia Department of Taxation can provide further guidance on specific requirements.

What is the penalty for the late filing of virginia offer in compromise?

The Virginia Department of Taxation does not specifically mention any penalties specifically for the late filing of an offer in compromise. However, it is important to note that the department may take various actions depending on the circumstances, including rejecting the offer, assessing further penalties and interest on the unpaid amount, and potentially pursuing other collection actions. If you are considering filing an offer in compromise, it is recommended to consult with a tax professional or reach out directly to the Virginia Department of Taxation for personalized guidance.

How can I manage my virginia offer in compromise directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your virginia offer in compromise and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send virginia offer in compromise to be eSigned by others?

When you're ready to share your virginia offer in compromise, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the virginia offer in compromise in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your virginia offer in compromise right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your virginia offer in compromise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.